A few months back I wrote a blog about College Funding. I explained that personal finance was a kind of hobby for me so this month I decided to expand the topic and provide my perspective on several other issues financial. Apologies to those who see much of this as basic. It may be, but I often run into people who could benefit from these reminders.

I welcome your comments and perspective.

CREDIT CARDS

I’ll start with Credit Cards because they are the source of many problems. Credit cards can be great tools but for the most part, they are the bane of our society. People get in way over their heads quickly. There was a great commercial a few months ago with people casually commenting on the actual cost of a computer, or a dress, or a meal, based on the fact that they were going to carry the charge on their credit card. Their friends were incredulous, but it happens every second of every day. Consider that a $500 purchase on a credit card that charges 18.5% APR (a bargain) would take 7 years to pay off and end up costing near $1000 if only minimum payments were made. The lesson is clear. Only use credit cards on things you can afford and pay off the balance each month. In fact, enroll in auto-pay of the entire balance each month.

I actually love credit cards and I use them for almost all of my expenses. I suggest the same for you. It makes it easy to track expenses for budgeting and there are many excellent cards that provide rewards. The Capital One Venture card is one example; no annual fee; no foreign fees, great app, and double miles for each dollar spent. There are many others. So, avoid the worst financial trap there is; do not go into debt with credit cards. If you currently have credit card debt, make it your primary goal to pay this off as soon as practical. Consider a balance transfer card, like Chase Slate, that charges no interest on transfers for a specific length of time, usually a year. Build a repayment plan and become the master of your domain.

INVESTMENTS

In my 20s and 30s I read a lot of personal finance books and one that was particularly impactful was The Motley Fool Investment Guide. Motley Fool is an investment company founded by the Gardner brothers in the early 90s.  Their first book was easily their best because they espoused honest advice before their success caused them to make recommendations that fed their growing company. Unfortunately, nobody gets rich recommending simple clear advice, so they changed their philosophy to align with creating a self-sustaining public company. Several takeaways from that book are more than obvious now, but rather revolutionary back then.

Their first book was easily their best because they espoused honest advice before their success caused them to make recommendations that fed their growing company. Unfortunately, nobody gets rich recommending simple clear advice, so they changed their philosophy to align with creating a self-sustaining public company. Several takeaways from that book are more than obvious now, but rather revolutionary back then.

- If you are going to invest in equities (and you must), do it through mutual funds instead of individual stocks. More on that later.

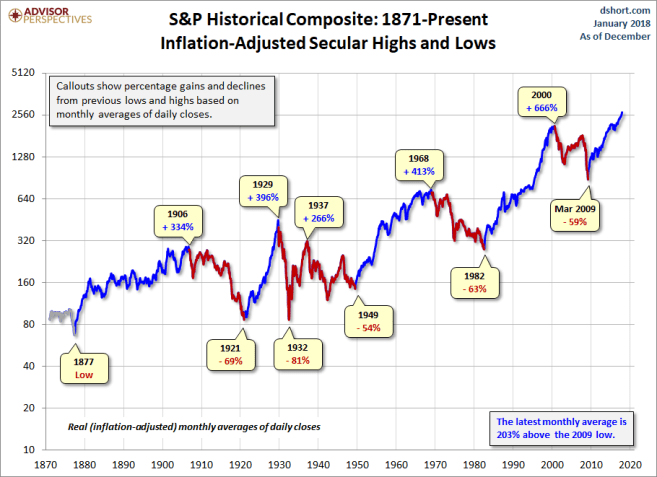

2. When investing in Mutual Funds, focus on funds that mimic popular indices (S&P 500, Russell 1000, etc) and always invest in no-load funds. Again, a no-brainer now, but for many decades investors have gladly paid front and/or back-end loads (fees) to fund companies and advisors. The assumption was that results would be dramatically better in a fund that was actively managed, so the fees were perfectly acceptable. Motley Fool (and a few others) pushed the idea that results with load funds were no better than those with no-loads. In fact, all the management (trading), capital gain distributions, and fees pushed costs so high that, when all are considered, load funds actually underperform. Significantly. Now you might be thinking that everybody knows this, but heavy advertising and financial advisor sales pitches have been misleading for many, many years. Oddly, while I was writing this blog this week I received the annual report for Berkshire Hathaway Inc. Chairman of the Board and investment guru Warren Buffett always writes an opening letter to shareholders. In this year’s letter he detailed the results of “The Bet”; a 10-year bet begun in December of 2007. The Bet was designed to test whether a near no-fee, unmanaged S&P 500 Index fund (Vanguard’s…exactly like what the MF brothers extolled in the early 90s) could, over time, outperform well-paid investment advisor’s choices. Buffett states that he undertook this bet to see if investors really do get anything for the billions of dollars that are paid to advisors. 5 different well-known and highly-regarded advisors put together portfolios of funds and actively managed them over the last 10 years. I’ll spare you the details but suffice it to say that the Vanguard Fund beat every competitor by netting an average annual gain of 8.5% with advisor portfolios coming in at .3%, 2.0%, 2.4%, 3.6%, and 6.5%. While investors with those great advisors would have lost an opportunity for real growth, rest assured that the advisors were paid handsomely, regardless of their performance. Warren Buffett concludes that “Investors both large and small should stick with low-cost index funds.” That means YOU and I.

What about stocks? Well, stocks are great, and every retirement portfolio needs to have exposure to equities to succeed. While most of that exposure should be in the form of groups of stocks (mutual funds or ETFs) in order to smooth out risk, there certainly is a place for stocks. I wholeheartedly endorse Peter Lynch’s philosophy of starting slowly with companies you know well based on your education, work or play experience. If you really like their product, and you understand that it has competitive advantages in the marketplace, that might be enough to buy. Sure, you can analyze earnings, growth, return on equity, profit margins and other data, but in the end, it is a company’s competitive position in the marketplace that drives success…Sales cure all ills. Just pick 6 to 8 great companies (like Amazon, Apple, Disney, Costco…) and slowly buy shares through a low-cost broker like E*TRADE or Ameritrade (or a no-cost broker like Robinhood). And hold them. For years; decades. Buy and Hold is the name of the game. That’s how you build real money.

401K

A great invention introduced in 1978, this is the primary asset relied upon by retirees. It’s important to do well here. I’m confident you are maximizing your Company match, which is probably the single most basic investment move. But simply investing up to your Company match won’t get you where you need to be. Most people do not make the best use of this account which accepts pre-tax money that grows tax-deferred money. That’s a potent combination that you cannot replicate anywhere else. In 2018 you can invest up to $18,500 of your own pre-tax money ($24,500 for those 50 or over). A general rule of thumb is to aim for saving 15% of your earnings for retirement. Now, the maximum 401K annual investment may be beyond your capacity right now, but it’s important to prioritize this and push as much as you can into this magical account. And pay attention to your investment choices, focusing on lower-cost Index funds in different sectors (Large Cap, Small cap, Value, Growth, International, etc). Diversify but stick with equities and stay the course through corrections. Don’t lock in losses by selling in a down market; keep the faith, the market always rebounds.

IRAs

Well, these are nice but maximizing your 401K contribution should be the priority. Don’t go here if you haven’t done that first. And if you are maximizing your 401K then pat yourself on the back and throw some money into a Roth IRA. The 2018 limit is $5,500; $6,500 for those 50 and older.

DOLLAR COST AVERAGING

Math is cool. And sometimes surprising. It tells us that when investing, go slow and steady. Resist dropping a ton of dough in the market all at once because you are, whether you realize it or not, timing the market. The price on that day will dictate your overall success. Instead, drop in routine automatic deposits each month. In this way, you will not be tied to one specific price and you will buy more shares when prices are lower, fewer when prices are higher…a really good thing. Watch:

Investment Price Shares

$500 $20 25

$500 $15 33.3

$500 $10 50

$500 $20 25

$500 $25 20

$500 $30 16.7

$500 $25 20

$500 $20 25

$4,000 215

During that little ride, your stock or fund went down and up but ended where it started. If you invested all $4,000 in the beginning, you would have 200 shares costing $20 each. But because you are smart, through dollar-cost-averaging you now own 215 shares with an average cost of only $18.60 (a 7% discount and a $300 gain). And the routine of an automatic investment ensures that your savings plan stays on track without any input from you.

Don’t over-analyze this. I did not rig the numbers; the price path taken above does not really matter. It always works, unless you make your large single purchase at the absolute lowest point of the ownership experience. And that is a rare thing indeed.

HOUSING

First, HOMES are not the savvy investment they once were, so think carefully about whether buying a house is the right move financially. I won’t go into the pros and cons here but suffice it to say that Renting has become a fiscally sound, viable option for many. But if you have your heart set on a home of your own, here are 2 suggestions, if at all financially possible:

- Put down at least 20% as a down payment. Any less will trigger a PMI payment (Private Mortgage Insurance). PMI is an offensive insurance policy the bank makes you take out for them in case you default. I am often amazed by the onerous nature of many financial transactions. PMI rates average about 1% of the loan amount per year, depending on your credit rating and size of the loan. If you put down only 10% on a $250,000 home, Principal & Interest on a 30-year loan would be about $1,000 per month but PMI would add an additional $200. Either wait until you’ve saved enough to put down that 20% or find a kind relative who will loan you the difference for less than the annual cost of PMI (in this case $2,250). Finally, PMI is hard to cancel, even after you’ve generated enough equity to cover 20% of the loan. Just don’t do it.

- Accelerate your mortgage. The benefits of a 15-year mortgage are tremendous. First, they are granted with lower interest rates than conventional 30-year mortgages. Over the life of a $250,000 loan, a homeowner will save over $100,000 just based on the difference in interest rate between a typical 15-year vs 30-year loan. Next, paying off a loan in half the time saves more than half the interest charged over the life of the loan. Keeping with our $250,000 loan, and keeping the interest rate the same for both a 30- and 15-year loan, interest would total almost $200,000 over the life of the 30-year loan, versus less than $100,000 for a 15. The total benefit of a 15-year loan is hundreds of thousands of dollars saved. Now, the payments will obviously be higher each month and that might not be so comfortable for those just starting out. Defaulting is bad; so the next best choice is to take out a 30-year mortgage and drop in a few extra dollars whenever you can. These dollars go straight to principal and will help shorten the length of the loan and still reduce overall costs significantly. THIS IS A REALLY GOOD THING TO DO.

Yes, there are those who will rightly say that most mortgage rates are low and extra money should go to other bills, or even the stock market, before paying off the home loan. To them, I say YES, if you have higher rate loans like a car, but we’ve already established that you have no credit card debt, and the stock market, as much as I love it, is still gambling. Speaking from personal experience, there is nothing like writing that last check on your mortgage. And the money previously earmarked for mortgage payments can now help with those tuition bills that are now coming due. (and your home equity can also serve as a source for low-interest home equity loans to help with underfunded education expenses.)

Bottom line:

- Live within your means and avoid credit card debt like the plague.

- Start your retirement savings plan early, shooting for 15% of earnings each year. Prioritize by fully funding your 401K first, then adding to a Roth IRA.

- Invest in the stock market using low-cost no-load Index Funds (esp. S&P 500)

- If you want to invest in individual stocks, use a low or no-fee broker and stick with 6-10 well-known growth companies and hold, hold, hold.

- Save for College through your state-sanctioned 529 plan, especially if your state carries special tax incentives (like the Indiana College Choice plan)

- Make your investments through free automatic monthly withdrawals. Dollar cost averaging will help juice your returns and your investment plan will continue without babysitting.

- Finally, you can do this all by yourself. Financial planners or advisors are expensive, provide very little value, expose you to difficult to understand products, and do not share in your risk. Be well, my friends.

Nice column Frank. Your last bullet is so true. 🙂

LikeLike